|

| policybazaar.com |

70 NEWS JAPAN - Many of us dream of becoming a Crorepati. However, only few of us would plan for it and achieve it. Although, you will find many considerable investment options such as Bank FD schemes, Non-Convertible Debentures (NCDs), company FD Schemes, all these options are either high-risk options or come with a lower return. However, ULIPs, on the other hand, can help you grow your small investment into Lakhs and Crores.

Read - Business Interruption Insurance: What It Will -- and Won't -- Cover

Did you know that an investment of Rs. 12, 000 per month, can make you Crorepati? Yes! You read it right. You DON’T need to invest a lakhs of rupees to become a Crorepati.

There are a lot of investors who struggle while seeking investment options. A few invest in the stock market and burn their fingers. A few of these investors make investments in company FD schemes and grumble about not getting returns by these companies. End of the story is that they lose money.

Being an investor, you can plan well and make the right investment where you don’t have to worry about the day-to-day fluctuations in the market. One of the most sought-after options to become a Crorepati is investing in Unit-Linked Insurance Plan (ULIP).

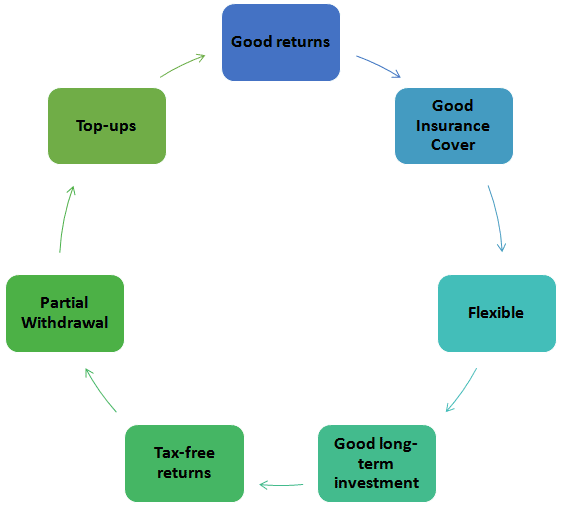

A Unit-Linked Insurance Plan or a ULIP offers an amalgamation of life cover and investment. As per the financial goal of the investor, risk tolerance, and time horizon, he can pick from a wide variety of fund options made available under the ULIPs of different insurance companies.

ULIPs are, particularly, the premiums’ invested portion, after the subtraction of all the premium and charges for your life coverage. The ULIP funds option is basically selected by the insured under all the unit-linked plans.

Read - How to Revive Lapsed LIC Insurance Policy Online

As ULIPs are investment-cum-insurance plans, they are one of the most productive options to pick for your investment. In the ULIP plan, the money is invested across the stock markets to produce abundant returns and offer you the coverage for a risk until the maturity of the policy.

0 Response to "How to Become a Crorepati by Investing Right"

Post a Comment